Phone 248.871.7756 | Email info@gmedicareteam.com

Watch Videos on

Search

Search

A detailed description of how it works.

Medigap plans (also known as Medicare Supplements) are one of the two main coverage options when it comes to choosing which coverage options best fit your unique needs while on Medicare. It is crucial that before we describe what Medigap plans are, we specify that these plans are NOT Medicare Advantage plans. You can learn more about Medicare Advantage plans Here.

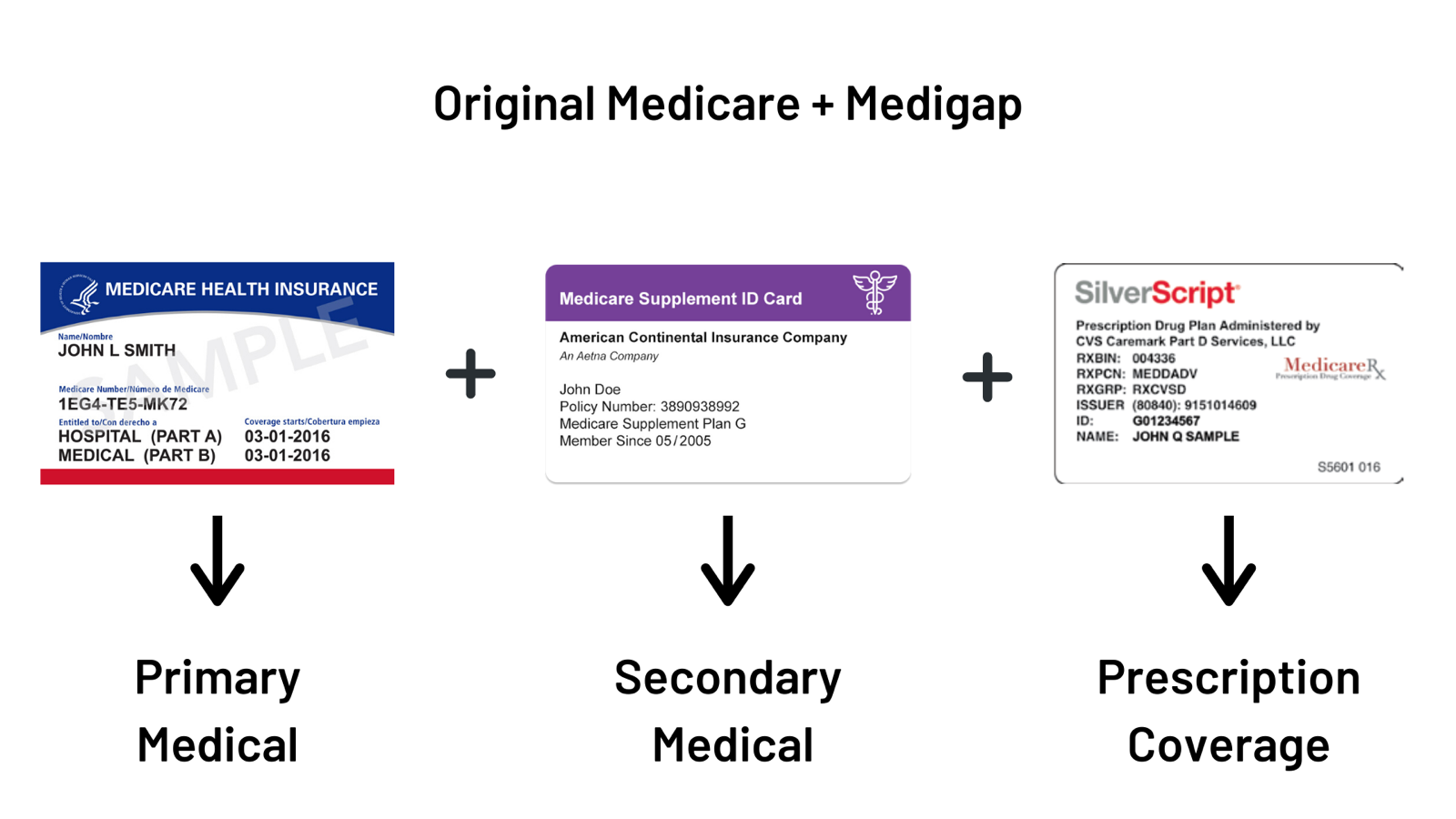

The Centers for Medicare & Medicaid Services (CMS) defines Medigap plans as “health insurance sold by private insurance companies to fill the gaps in Original Medicare.” When you choose to enroll in a Medigap plan, your primary coverage is still Original Medicare (Parts A and B), and your Medigap plan becomes your secondary coverage. It is crucial to remember this when it comes to an understanding of how Medigap plans work.

Throughout this whole process of learning more about Medigap coverage, remember that because Medicare remains your primary coverage, they are “the boss.” What we mean by this is that your Medigap insurance does not dictate where, when, or how you seek medical treatment. Instead, you have the freedom and flexibility to receive Medicare-approved care at any provider or facility around the country that accepts Original Medicare.

So long as a facility or provider accepts Original Medicare, they have to take your Medigap plan, regardless of the private insurance company that provides your coverage. Instead of asking, “do you take XYZ insurance company?” you can ask, “do you accept Original Medicare?”.

Generally speaking, Original Medicare covers 80% of the cost of medical procedures, and you are responsible for the remaining 20%. The Medigap plan you choose will help cover the remaining 20% of medical expenses, depending on the type of plan (below) that you select.

Lastly, Original Medicare does not provide prescription drug coverage; therefore, Medigap will not cover prescription drug costs either. Individuals that choose to enroll in a Medigap plan will also want to enroll in a stand-alone prescription drug coverage known as “Part D.” Private insurance companies provide Part D coverage (not the federal government). We can help you find the unique Part D coverage to compliment your Medigap coverage.

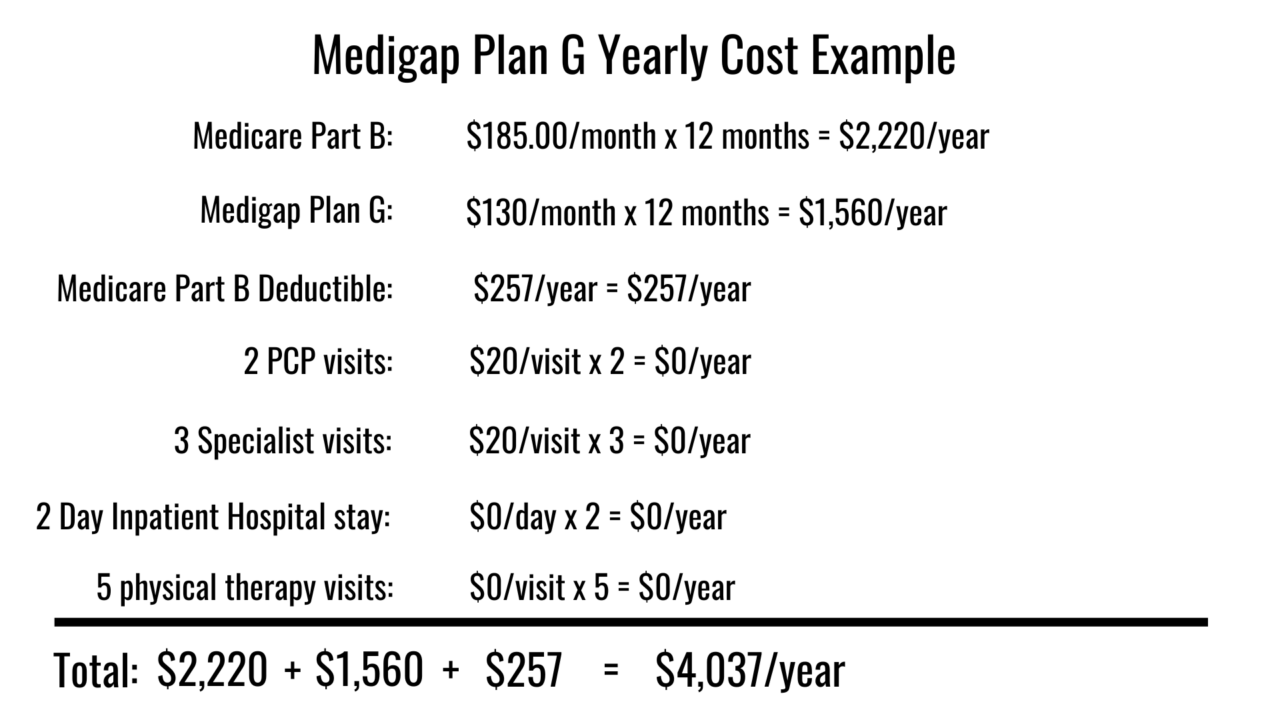

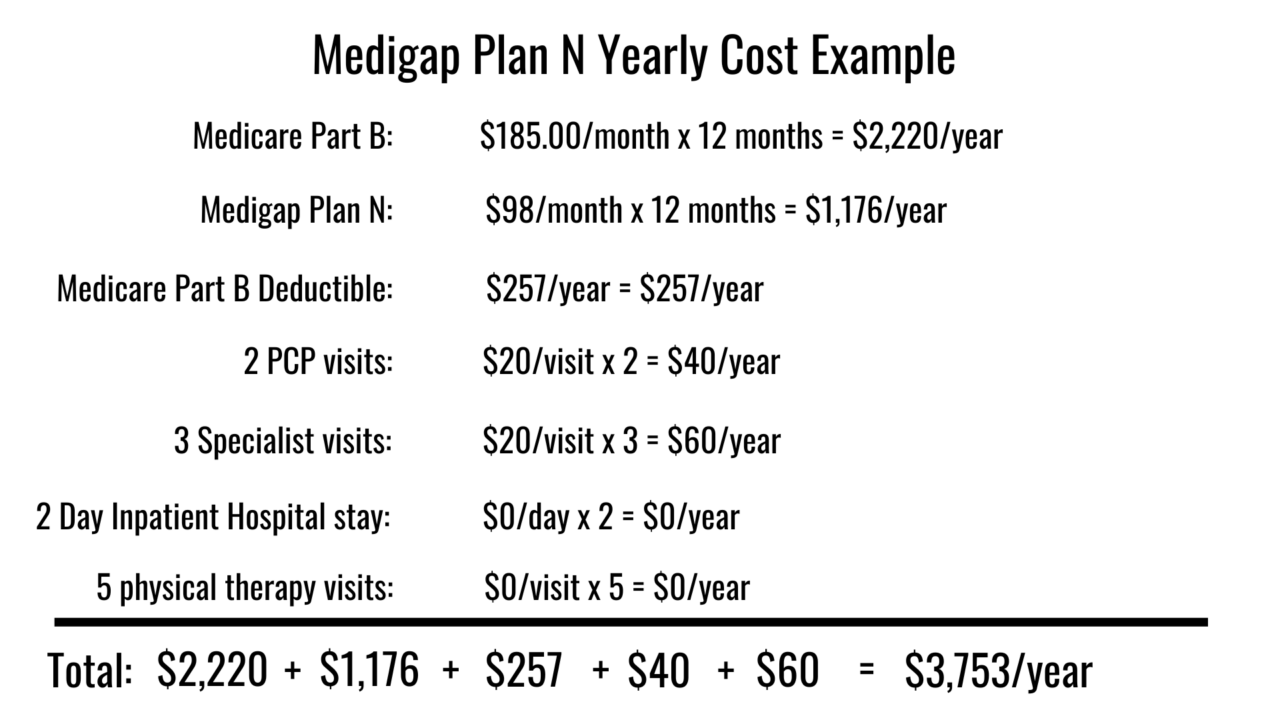

Just like with all health insurance, the cost of Medigap coverage needs to placed into two categories:

Medigap coverage generally has higher fixed monthly premiums (compared to Medicare Advantage plans), but lower variable out of pocket costs should you need medical care. Both monthly premiums and out of pocket costs for Medigap plans depend on which standardized Medigap plan you select.

In this example, you can see the estimated monthly premiums and yearly out of pocket medical costs for a 65-year-old (in Metro Detroit) that chooses a Medigap Plan G as their coverage option.

And, here is another example of the monthly premiums and out of pocket costs with Medigap Plan N.

Remember, Part D prescription drug coverage costs should also be added to the overall cost of Medigap coverage as you will likely want to purchase Part D coverage as well.

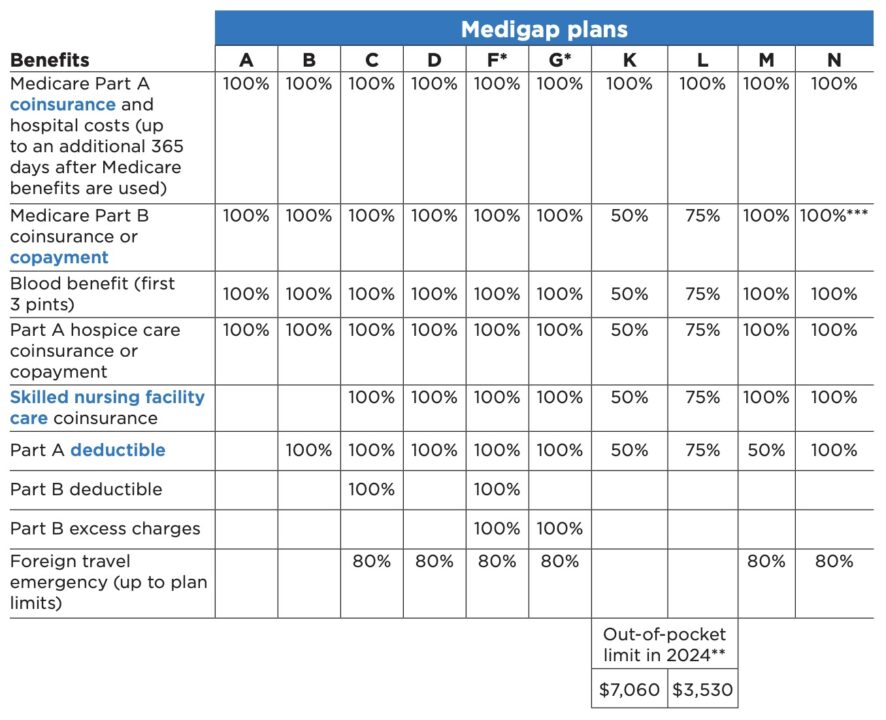

The Centers for Medicare and Medicaid Services (CMS) states that “Insurance companies can only sell you a “standardized” Medigap (Medicare Supplements) policy. Medigap policies must follow Federal and state laws. These laws protect you. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.”

Because Medigap plans are standardized, you will often hear Medigap (Medicare Supplements) plans referred to by a specific letter (ex. Plan G, Plan N, etc.). There is no difference in base benefits for Plan G from company X compared to Plan G from company Y.

Here is a chart from the official “Medicare & You Handbook” showing the benefits of the ten standardized Medigap (Medicare Supplements) plans currently offered to consumers:

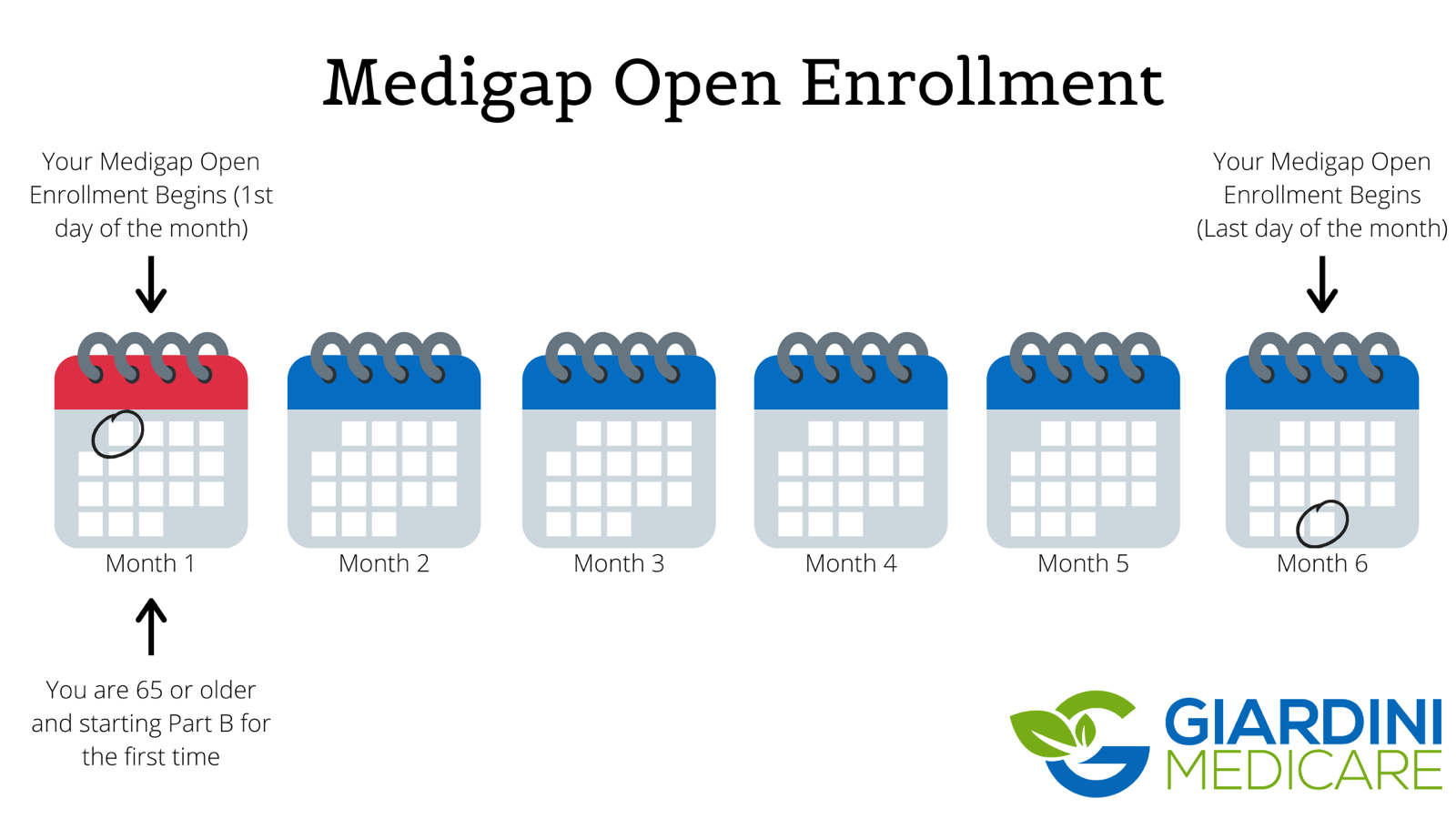

The best time to decide whether Medigap coverage is right for you, or even which Medigap plan is right for you is during your Medigap Open Enrollment Period. This Open Enrollment Period is NOT the same as the Annual Election Period (often incorrectly referred to as “open enrollment”) that occurs from October 15th – December 7th. Instead, your Medigap Open Enrollment period is directly related to you the individual, and it is unique to everyone that is beginning their Medicare coverage.

The Centers for Medicare and Medicaid Services (CMS) states, “Your individual Medigap Open Enrollment Period begins the first day of the month that you a both 65 or older AND enrolled in Medicare part B.”

In most states, if you wish to enroll in a Medigap plan outside of your one-time six-month open enrollment, you will have to go through medical underwriting (in the form of health questions and possible medical background checks). You may be denied the ability to purchase a Medigap plan outside of your open enrollment period if you have certain pre-existing conditions at the time of your new Medigap application. Every Medigap company has different health underwriting criteria, so give us a call, and we can help you decide which company may be right for you.

We are not here to try and make it sound like once your Medigap Open Enrollment Period has passed, you will never be able to purchase a Medigap plan in the future. We help people year-round switch from one Medigap plan to another. Many consumers are unaware that if you can pass underwriting, you can change your Medigap coverage 365 days of the year!

Comprehensive Medical Coverage // The most popular Medigap plans (typically G, N, and F) leave very little out of pocket medical costs for consumers that choose to enroll in one of those plans. Remember from the chart above that Plan F covers all the out of pocket medical costs for Medicare-approved procedures. Likewise, Plan G will cover the same out of pocket medical costs after you have satisfied your once per calendar year Part B deductible ($257 for 2025). For help determining what procedures Original Medicare covers, you can go HERE to Medicare.gov or download the app for your smartphone below:

Nationwide Coverage // Medigap plans are not HMOs or PPO’s like Medicare Advantage plans and therefore do not require you to receive treatment at “in-network” providers for lower-cost treatment. Instead, Original Medicare remains your primary insurer when you enroll in Medigap coverage. Because Medicare is primary, you can seek care at any facility or provider in the country that accepts Original Medicare. Make sure that if you call a doctor’s office to find out if they will take your Medigap plan, you ask, “do you accept Original Medicare.”

Budgeting // The most popular Medigap plans (plan G and N) cover most of the costs remaining after Original Medicare has paid their portion. Typically, this means that your out of pocket medical costs won’t fluctuate as much throughout the year when you do need to seek treatment. In retirement, having a relatively fixed monthly premium for medical care can help with budgeting and help ease the burden of unexpected medical bills.

Separate Drug Coverage // Now, I know what you are likely thinking, how is having separate prescription drug coverage in the form of Part D a benefit when it comes to choosing Medigap coverage? Well, having separate prescription coverage from your medical coverage means that you can choose Part D coverage that best fits your unique needs. Additionally, during the Annual Election Period (AEP) from October 15th – December 7th you can change your Part D coverage without impacting your Medigap coverage

With Medicare Advantage, on the other hand, your medical coverage and prescription coverage are administered by one insurance company in a “bundled all-in-one” plan. Meaning, when you are first choosing your coverage or looking to change to a different Medicare Advantage plan, you must make sure that your bundled coverage adequately covers both your doctors as well as prescriptions.

Medigap plans tend to offer a more “a la carte” approach to choosing Medicare coverage.

Guaranteed Renewable // The official “choosing a Medigap policy” handbook summarizes this best, “any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can’t cancel your Medigap policy as long as you stay enrolled and pay the premium.”

Outside of your Medigap insurer declaring bankruptcy and going out of business, your Medigap coverage will continue with the same benefits for the duration of your time on Medicare if you continue to pay your monthly premium. We recommend that our clients pay their Medigap premiums with automatic EFT payments for this very reason.

Higher Monthly Premiums // The comprehensive medical coverage with a Medigap plan, of course, comes with a higher monthly premium when compared to most Medicare Advantage Plans. Like we mentioned earlier, a 65-year-old in Michigan can expect to pay about $130-$150/month for a Medigap plan G. That same 65-year-old could likely find a Medicare Advantage plan available in their zip code for $0/month.

Few “Extra Benefits” // Medigap plans by design, cover the out of pocket costs for treatments and procedures approved by Original Medicare (Parts A and B). Therefore, Medigap plans typically do not cover extra benefits not provided by Original Medicare. Some examples of the additional benefits not offered include routine dental/vision/hearing coverage, over the counter benefits, yearly physicals, prescription coverage, and fitness memberships (some Medigap companies do offer no-cost fitness memberships). One exception to this is that the more popular Medigap plans do include some coverage for foreign emergency care, which is not provided by Original Medicare. Lastly, additional dental/vision/hearing coverage can be purchased separately to compliment your Medigap coverage.

Rate Increases // Along with higher monthly premiums, Medigap monthly premiums also increase during the lifetime of your Medigap coverage. You can almost always expect your plans monthly premiums to increase by a few percentage points every year due to various factors. Medigap plans undergo rate increases depending on how your plan is “rated.” The three main types of Medigap premium “ratings” include:

Give us a call so we can help you find the different rating options available to you in your zip code.

Separate Prescription coverage // Wait, wasn’t this a benefit of Medigap coverage? Well, the answer is that having separate prescription coverage is both a positive and a negative to Medigap coverage. Yes, the separate coverage allows for greater flexibility and customization, but it also comes with additional monthly premiums. Contrast this with Medicare Advantage plans that include prescription drug coverage at no added monthly premium.

More insurance to keep track of // Lastly, Medigap coverage typically comes with more insurance to keep track of, due to it’s a la carte style. What do we mean by this? Well, should you choose Medigap coverage, you will likely have your red/white/blue Medicare card, Medigap insurance card, Part D card, and possibly a dental/vision/hearing card. Whereas Medicare Advantage plans typically include all of this coverage in one plan (one card). Now, this is NOT a reason we would ever recommend one plan over the other, but it can be a negative for some consumers. Luckily we can help!

Medigap (Medicare Supplements) plans come in ten different “standardized” packages, and it is essential to understand which plan best fits your needs when you are first beginning Medicare Part B. Outside of your Medigap Open Enrollment period, it may be difficult to enroll into a new Medigap plan for the first time. Medigap coverage and Medicare Advantage plans are NOT the same when it comes to coverage, so make sure you take the time to compare both options. We are here to help you decipher your Medigap options so you can transition to Medicare with confidence.